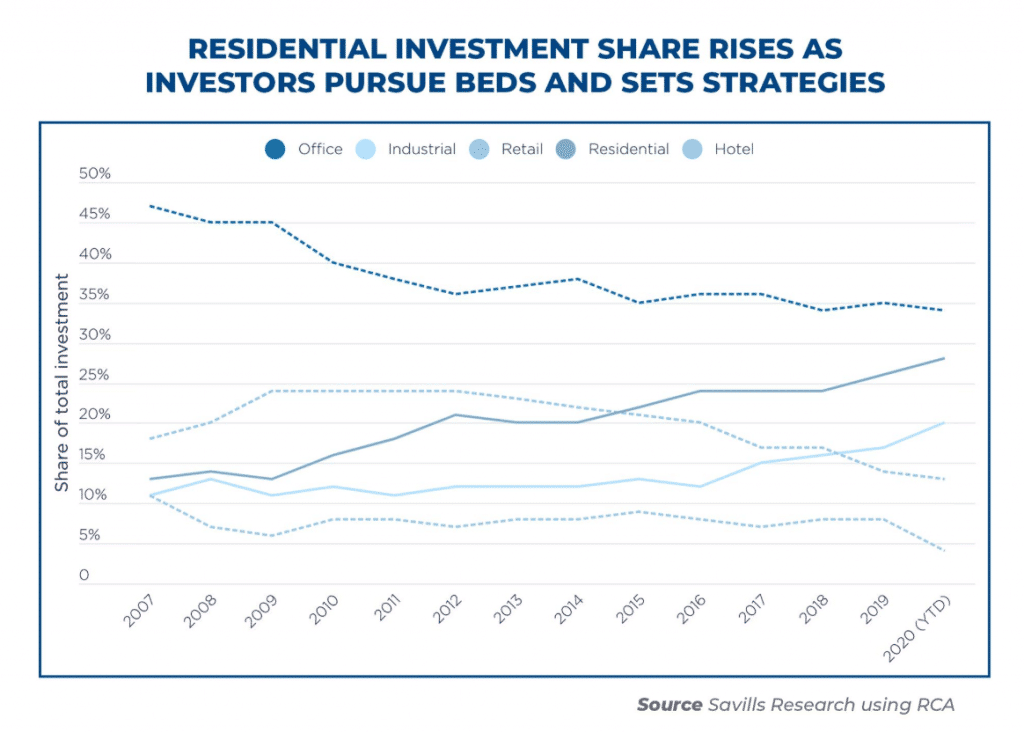

According to the Savills Global Living Report 2020, operational residential investment represents 27% of global real estate investment in the first three quarters of 2020, compared to 16% a decade ago.

(Operational investments include multi-family housing, student housing and senior residential assets)

In today’s difficult macroeconomic environment, the sector’s resilience and strong fundamentals remain valid. Demographic trends and affordability constraints continue to drive demand for rental housing. Savills showed that while residential investment volumes during Q1, Q2 and Q3 of this year were down 31%, it was the least dramatic drop among property types, alongside logistics (in decrease of 16%). However, offices and retail on their part fell by 37% and 38%, respectively, when compared to the same period in 2019.

The figures come after a record year in 2019 when a total of $ 297 billion was injected into the sector.

Global Research Director at Savills Paul Tostevin said: “Even with wider global uncertainty as a result of COVID-19, the operational residential sector has held up better than some others this year. Investment activity has largely been driven by the consolidation of companies across subsectors including multifamily and student housing. Despite the near-term effects of the pandemic from a macroeconomic point-of-view, the longer-term growth in capital volumes targeting operational residential assets speaks for itself. Investors are not only seeking to diversify their real estate portfolios, but are looking for those stable income-streams for which the sector has become so renowned.”

Now standing at $ 46 billion from Q4 2019 to Q3 2020 and accounting for 22% of total residential investment, the study also reports that cross-border investment in operational residential areas has grown significantly. An increase from 14% that represented cross-border transactions in 2016 is shown.

2019 was the most successful year to date for multi-family assets, with $ 223 billion traded, multi-family is by far the largest of the global residential sub-sectors. Of that total, 71 percent were in the United States, the largest and most mature market, followed by Western Europe with 24 percent. Western Europe’s share (including the UK) increased to 27% in the first three quarters of 2020, as the industry grows outside the UK.

Despite the headwinds brought on by COVID-19 and, consequently, the effects of the disruption of school and university mandates, student housing has also proven its resilience. Consolidation has been a key driver in the student housing sector: in the UK, Unite Students REIT bought Liberty Living from the Canadian Pension Plan Investment Board for a reported amount of $ 1.8 billion , as in the case of multi-family dwellings.

Savills’s head of European investment and development, operational capital markets, Marcus Roberts, said: “2020 has seen some truly impressive transactions in the operational residential sector, cementing it as one of the most favorable asset classes. With the long-term picture showing an uptick in global mobility, we expect significant opportunities to remain for investors wishing to diversify their real estate portfolios. While there is no shortage of capital targeting the sector, the challenge (and opportunity) in Europe, at least, is finding prime development sites, completed assets or conversion prospects in which to invest.”

With yield compression increasing as the maturity of the industry becomes more apparent, multi-family yields in particular are now stabilizing in most markets following a significant downward trend in yields over the past five years.

The loan market is in a much stronger position compared to the global financial crisis as a whole, when it comes to lending even though the credit markets have eased. Non-bank lenders (who are now more prevalent) are ready to seize opportunities with more risk, while banks are now more cautious.

Ultimately, residential remains a favorable asset class to lend against, thanks to the industry’s long-term fundamentals.